The table below shows the bonds and notes that have been issued and the facilities that have been put in place by the Group.

| Issuer | Original amount (million) |

Amount outstanding (million) |

Maturity | Fixed/ Floating |

Coupon | Coupon frequency |

|---|---|---|---|---|---|---|

| 3i Group plc | EUR 500 | EUR 500 | 14 Jun 29 | Fixed | 4.875% | Annual |

| 3i Group plc | GBP 400 | GBP 375 | 03 Dec 32 | Fixed | 5.750% | Semi-annual |

| 3i Group plc | GBP 400 | GBP 400 | 05 Jun 40 | Fixed | 3.750% | Semi-annual |

Click here to see the bond documentation.

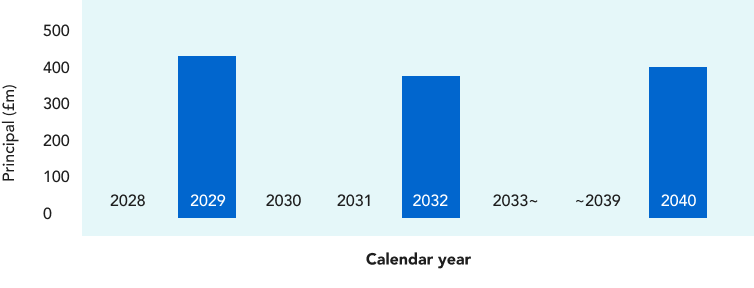

The maturity profile of our bonds is shown on the following chart.

Debt maturity profile

| Borrowers | Committed | Start Date | Maturity Date | Type |

|---|---|---|---|---|

| 3i Group plc | £900m: £500m committed until March 2027, £400m committed until November 2026 | 13 Mar 20 | 13 Mar 27 | Multi-currency revolving credit facility |

The Group maintains a committed revolving credit facility (“RCF”) to provide additional liquidity.

The RCF has no financial covenants.