3i invests c.€116m in IT managed services provider Constellation

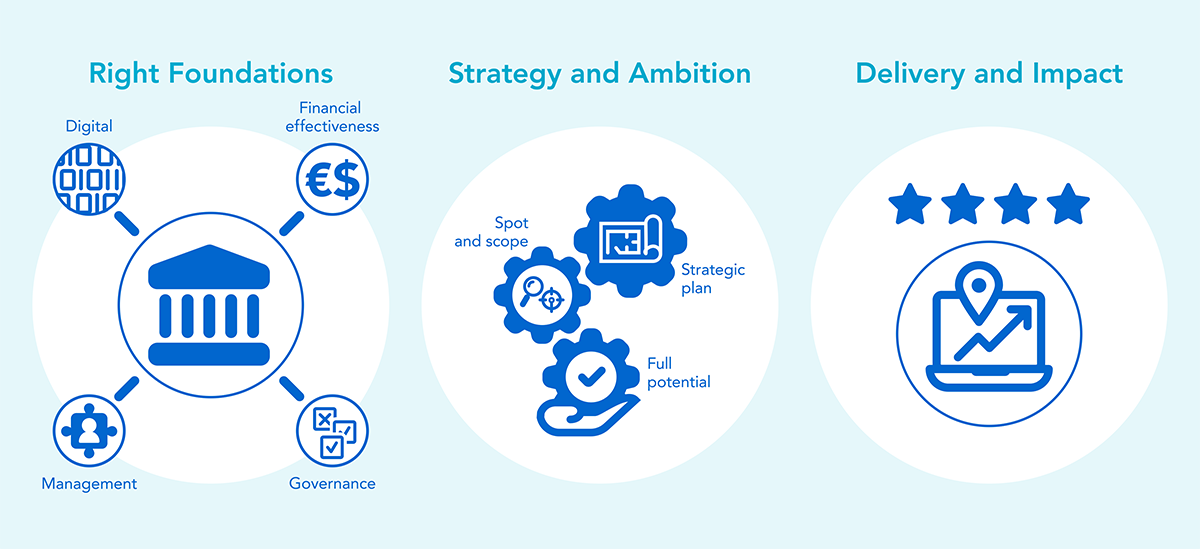

Active Partnership is how we work with our portfolio companies to achieve their full potential. Our approach is systematic, adapted according to the specific situation and company.

We partner with management to set the strategic position for the business and to develop a blueprint for the next 3 to 5 years.

Our international network of Business Leaders and top tier advisers work alongside management to deliver growth.

Our in-house banking team has a broad international remit and is responsible for the firm's relationships with its financing institutions. The team provides specialist banking advice spanning all key financing stages associated with new and existing portfolio assets across 3i’s Private Equity business.

This includes raising primary acquisition finance, advising on the management of leveraged capital structures and preparing exit financing. Financing products cover the full debt capital markets spectrum.

The 3i Business Leaders Network (“BLN”) refers to our global network of experienced executives developed over the last 30+ years, who bring insights into sectors, business models and specific situations across our investment journey.

We look to partner with our BLN at all stages of a deal from the origination of new opportunities, through the diligence of specific assets or sectors, to sitting on our Boards. We continually look to augment our network in line with our investment and portfolio strategy.

Our portfolio companies benefit from our BLN as they gain access to best-in-class Chairs, as well as executive and non-executive contacts, with deep sector and international expertise to help them drive growth and value across their businesses.